Automating your accounts receivable can also help reduce the administrative burden of managing it, such as sending automated reminders, invoicing, and tracking payments. Accounts receivable turnover measures how efficiently your business collects revenues from customers to whom goods are sold on credit. The customers to whom you sell goods or services on credit are recorded as trade debtors or accounts receivable in your books of accounts.

3 Receivables – before the adoption of ASU 2016-13

The percentage that Square charges stays constant until the loan is paid off fully. Note that the interest component decreases for each of the scenarios even though the total cash repaid is $5,000 in each case. In scenario 1, the principal is not reduced until maturity and interest would accrue over the full five years of the note. For scenario 2, the principal is being reduced on an annual basis, but the payment is not made until the end of each year. For scenario 3, there is an immediate reduction of principal due to the first payment of $1,000 upon issuance of the note. The remaining four payments are made at the beginning instead of at the end of each year.

When Cash Is Received For Goods Sold On Credit

But what if the customer does not pay within the specified contract length? A lender will still pursue collection of the note but will not maintain a long-term receivable on its books. Instead, the lender will convert the notes receivable and interest due into an account receivable. Sometimes a company will classify and label the uncollected account as a Dishonored Note Receivable. Using our example, if the company was unable to collect the $2,000 from the customer at the 12-month maturity date, the following entry would occur. Notes receivable can arise due to loans, advances to employees, or from higher-risk customers who need to extend the payment period of an outstanding account receivable.

Double Entry Bookkeeping

The length of contract is typically over a year, or beyond one operating cycle. There is also generally an interest requirement because the financial loan amount may be larger than accounts receivable, and the length of contract is possibly longer. A note can be requested or extended in exchange for products and services or in exchange for cash flow from financing activities cash (usually in the case of a financial lender). Several characteristics of notes receivable further define the contract elements and scope of use. The total discount $480 amortized in the schedule is equal to the difference between the face value of the note of $10,000 and the present value of the note principal and interest of $9,250.

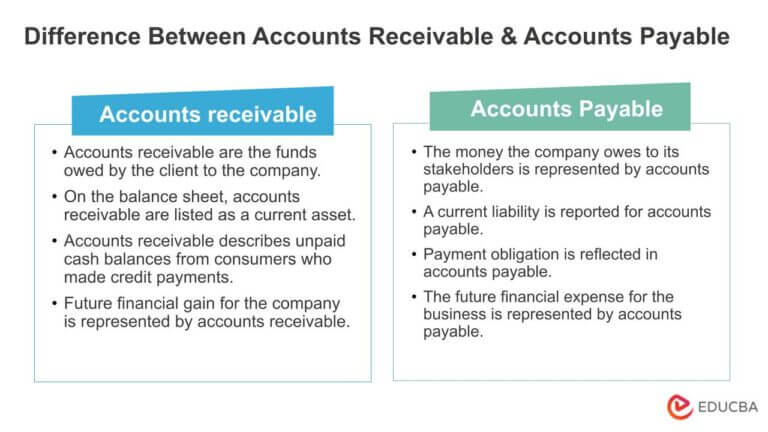

That is, you record accounts receivable in general ledger accounts under the account titled ‘Accounts Receivable’ or ‘Trade Debtors’. They are assets that can be classified as current or long-term based on the duration of the note. Another important difference between accounts payable and accounts receivable is how they affect working capital. Simply put, accounts payable (AP) reduce available working capital, as they represent upcoming cash outflows. Conversely, accounts receivable are assets when a customer owes the company money.

Tips For Effective Accounts Payable And Receivable Management

In other words, the credit balance in the allowance for doubtful accounts tells you the amount that is to be collected from your credit customers. This means the bad debts expense account gets debited and the allowance for doubtful accounts gets credited whenever you provide for bad debts. In other words, you provide goods and services to your customers instantly, but you receive payments for such goods and services after a few days.

Notes Receivable due in more than one year are listed in the Long-term Asset section of the Balance Sheet. Another option for encouraging clients to pay invoices on time is to charge late fees. In the rapidly evolving field of artificial intelligence and machine learning, data labeling has become a big part of training models to make accurate predictions.

- You are the owner of a retail health food store and have severallarge companies with whom you do business.

- Since its founding in 2009 and the launch of its first app in 2010, Square has found its way into many small businesses – and large businesses.

- Interest Income or Interest Revenue is increased on the credit (right) side of the account and decreased on the debit (left) side of the account.

- This is done to calculate the net amount of accounts receivable anticipated to be collected by your business.

- Note that some textbooks use 360 days in a year, and some textbooks use 365 days in a year.

- The interest rate is the partof a loan charged to the borrower, expressed as an annualpercentage of the outstanding loan amount.

The maturity date is the date when the payee must pay the ending balance of the note. The term is the period from the date of issuance to the date of maturity. As the note receivable is interest-bearing, the payee is bound to pay the interest as per the annual interest rate mentioned in the notes receivable. So the ending note balance here is the principal amount plus the interest calculated through the maturity date. BWW issued Sea Ferries anote in the amount of $100,000 on January 1, 2018, with a maturitydate of six months, at a 10% annual interest rate.

When customers pay cash, the company credit accounts receivable and debit cash. For instance, if a company receives inventory worth $2,000 with payment terms of 30 days, this $2,000 will be logged as an AP entry detailing the payment date and vendor information. This tracking helps with managing cash flow and fulfilling obligations on time.

Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Sign up to a free course to learn the fundamental concepts of accounting and financial management so that you feel more confident in running your business.